All Categories

Featured

Table of Contents

- – What financial goals can I achieve with Genera...

- – What is Wealth Management With Infinite Banking?

- – Private Banking Strategies

- – How do I leverage Infinite Banking to grow my...

- – Infinite Banking Concept

- – How do I optimize my cash flow with Wealth M...

- – How do interest rates affect Infinite Bankin...

Term life is the best remedy to a momentary demand for securing against the loss of a breadwinner. There are much fewer factors for long-term life insurance coverage. Key-man insurance policy and as part of a buy-sell agreement come to mind as a feasible excellent reason to buy a permanent life insurance plan.

It is an expensive term coined to offer high priced life insurance policy with enough payments to the agent and substantial revenues to the insurance provider. Financial leverage with Infinite Banking. You can get to the same end result as infinite financial with much better outcomes, more liquidity, no danger of a policy gap setting off a substantial tax problem and even more alternatives if you use my options

What financial goals can I achieve with Generational Wealth With Infinite Banking?

Compare that to the prejudices the promoters of infinity financial obtain. 5 Errors People Make With Infinite Financial.

As you approach your golden years, monetary safety is a leading priority. Among the lots of various economic approaches out there, you may be listening to more and much more concerning limitless financial. Self-financing with life insurance. This idea allows nearly anyone to become their own bankers, supplying some advantages and adaptability that could fit well into your retirement

What is Wealth Management With Infinite Banking?

The finance will certainly accumulate simple passion, yet you maintain adaptability in setting settlement terms. The rates of interest is likewise generally lower than what you 'd pay a typical bank. This sort of withdrawal permits you to access a part of your cash money value (up to the quantity you've paid in premiums) tax-free.

Many pre-retirees have concerns regarding the safety and security of limitless banking, and for great factor. The returns on the cash worth of the insurance policies may vary depending on what the market is doing.

Private Banking Strategies

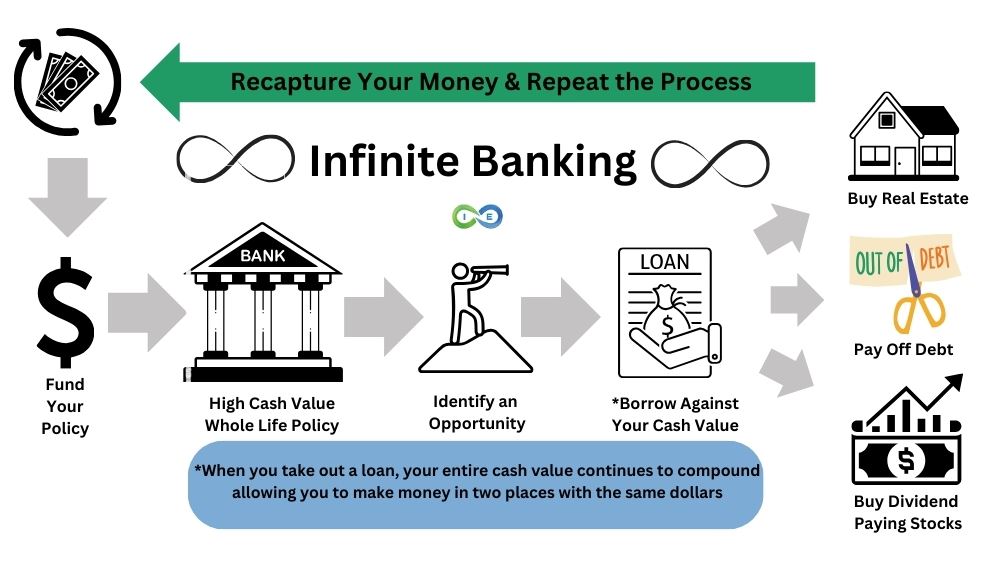

Infinite Banking is a financial technique that has actually acquired substantial interest over the previous couple of years. It's an one-of-a-kind technique to taking care of personal finances, permitting individuals to take control of their cash and produce a self-sufficient financial system - Infinite wealth strategy. Infinite Banking, also called the Infinite Financial Principle (IBC) or the Count on Yourself approach, is a financial approach that entails making use of dividend-paying entire life insurance policy policies to create a personal banking system

To comprehend the Infinite Financial. Idea strategy, it is for that reason crucial to provide a review on life insurance as it is an extremely misunderstood asset class. Life insurance policy is a crucial part of monetary planning that gives numerous benefits. It comes in numerous sizes and shapes, one of the most common kinds being term life, entire life, and universal life insurance policy.

How do I leverage Infinite Banking to grow my wealth?

Let's discover what each type is and just how they vary. Term life insurance policy, as its name recommends, covers a certain period or term, normally between 10 to 30 years. It is the simplest and usually the most inexpensive sort of life insurance policy. If the insurance holder passes away within the term, the insurance company will pay out the fatality advantage to the assigned recipients.

Some term life plans can be renewed or converted right into a long-term policy at the end of the term, but the costs typically increase upon renewal as a result of age. Entire life insurance policy is a kind of long-term life insurance that offers insurance coverage for the policyholder's whole life. Unlike term life insurance, it consists of a cash worth component that grows gradually on a tax-deferred basis.

However, it is necessary to bear in mind that any kind of superior lendings taken versus the policy will lower the survivor benefit. Entire life insurance policy is commonly extra costly than term insurance policy because it lasts a lifetime and constructs cash value. It also provides predictable premiums, meaning the cost will not increase gradually, supplying a degree of certainty for insurance policy holders.

Infinite Banking Concept

Some reasons for the misunderstandings are: Intricacy: Whole life insurance plans have much more intricate functions contrasted to describe life insurance policy, such as cash value accumulation, dividends, and policy car loans. These attributes can be challenging to understand for those without a history in insurance policy or personal financing, leading to complication and false impressions.

Prejudice and false information: Some people might have had unfavorable experiences with whole life insurance policy or listened to stories from others that have. These experiences and anecdotal info can contribute to a biased sight of whole life insurance policy and continue misunderstandings. The Infinite Financial Concept approach can only be applied and implemented with a dividend-paying whole life insurance policy with a mutual insurance policy company.

Whole life insurance policy is a sort of irreversible life insurance that provides coverage for the insured's whole life as long as the costs are paid. Whole life plans have two main elements: a death benefit and a money value (Wealth management with Infinite Banking). The survivor benefit is the quantity paid to recipients upon the insured's death, while the cash money value is a cost savings component that grows with time

How do I optimize my cash flow with Wealth Management With Infinite Banking?

Reward repayments: Shared insurer are had by their insurance holders, and because of this, they might distribute revenues to insurance policy holders in the kind of rewards. While dividends are not assured, they can assist boost the cash worth growth of your plan, enhancing the general return on your resources. Tax advantages: The cash value development within a whole life insurance plan is tax-deferred, indicating you do not pay taxes on the growth till you withdraw the funds.

This can supply considerable tax obligation benefits contrasted to other cost savings and financial investments. Liquidity: The cash money value of an entire life insurance policy plan is very fluid, enabling you to access funds quickly when required. This can be particularly useful in emergencies or unanticipated monetary circumstances. Possession defense: In many states, the cash money worth of a life insurance policy policy is secured from lenders and suits.

How do interest rates affect Infinite Banking Wealth Strategy?

The plan will certainly have instant cash value that can be placed as security 1 month after moneying the life insurance policy policy for a rotating line of debt. You will be able to access via the rotating credit line as much as 95% of the available cash money value and use the liquidity to money an investment that supplies income (capital), tax advantages, the chance for appreciation and utilize of various other individuals's skill collections, capabilities, networks, and resources.

Infinite Banking has become really prominent in the insurance world - also more so over the last 5 years. R. Nelson Nash was the developer of Infinite Financial and the organization he established, The Nelson Nash Institute, is the only organization that officially licenses insurance representatives as "," based on the complying with standards: They straighten with the NNI requirements of professionalism and principles (Infinite wealth strategy).

They efficiently finish an instruction with an elderly Licensed IBC Practitioner to ensure their understanding and capacity to apply all of the above. StackedLife is Licensed IBC in the San Francisco Bay Area and works nation-wide, aiding customers recognize and execute The IBC.

Table of Contents

- – What financial goals can I achieve with Genera...

- – What is Wealth Management With Infinite Banking?

- – Private Banking Strategies

- – How do I leverage Infinite Banking to grow my...

- – Infinite Banking Concept

- – How do I optimize my cash flow with Wealth M...

- – How do interest rates affect Infinite Bankin...

Latest Posts

Infinite Banking 101

Borrowing Against Whole Life Insurance

Be Your Own Bank Whole Life Insurance

More

Latest Posts

Infinite Banking 101

Borrowing Against Whole Life Insurance

Be Your Own Bank Whole Life Insurance